Media Contact:

Shruti Gondaliya

Media Relations Coordinator

Email: [email protected]

Phone: +1(781)742-8797

NACA Brings “Achieve the Dream” Homeownership Event to Milwaukee, Sept 20-22

Homebuyers Can Access NACA’s Best Mortgage in America — No Down Payment, No Closing Costs, No Fees, and No PMI, at Below-Market Fixed Interest Rates

Milwaukee, WI – September 9, 2024 — NACA, the nation’s largest HUD-approved non-profit homeownership and advocacy organization, is bringing its highly acclaimed Achieve the Dream event to Milwaukee for three days, from Friday, September 20th through Sunday the 22nd. The event will be held from 8:00 AM to 8:00 PM at the Hyatt Regency, 333 West Kilbourn Ave, Milwaukee, WI 53203.

NACA’s Achieve the Dream event offers a unique, one-stop homeownership experience, providing Milwaukee residents, others from around the state and nationwide with the opportunity to access NACA’s Best in America Mortgage: no down payment, no closing costs, no fees, no mortgage insurance, at a below-market fixed interest rate without consideration of one’s credit score. Whether you’re a prospective homebuyer paying high rent or a homeowner struggling with high mortgage payments, NACA is the place to achieve real affordable solutions.

What Participants Can Expect:

- NACA Homebuyer Workshop: Learn about NACA’s housing programs and homeownership opportunities.

- Streamlined Information/Document Upload: Upload information and necessary documents on NACA’s Member Portal for a smooth process.

- Personalized Counseling: Receive one-on-one housing counseling from a NACA HUD-certified counselor.

- Mortgage Qualification: Meet with a NACA mortgage specialist to get qualified for NACA’s Best in America Mortgage.

- Immediate Action: Many attendees achieve same-day NACA Qualification, allowing them to begin their home search or plan their next steps immediately.

As of September 9, 2024, NACA’s Best in America Mortgage fixed rate is 5% for a 30-year term regardless of credit score.

In addition, Section 8/Housing Choice Voucher holders can use their voucher for the mortgage payment accessing all the benefits of NACA’s Best in America Mortgage. They have a unique opportunity to move from public assistance to affordable homeownership and build significant generational wealth.

“NACA’s homeownership programs are truly the best in the country, and as incredible as they sound, the results are even better,” said Bruce Marks, CEO of NACA. “Thousands will attend our Achieve the Dream event in Milwaukee because their family, friends, co-workers, and neighbors know that NACA is the path to affordable homeownership. Take the first step toward a more secure future—we’ll see you in Milwaukee.”

All services provided by NACA are free of charge, reinforcing the organization’s dedication to community support and advocacy. Homebuyers have everything to gain and nothing to lose by attending this event.

To register for the event, please visit: https://www.nacalynx.com/naca/webfile/member/event/eventType.aspx?txtEvent=GB

Watch a recap video of our most recent NACA Achieve the Dream event in Newburgh, NY:

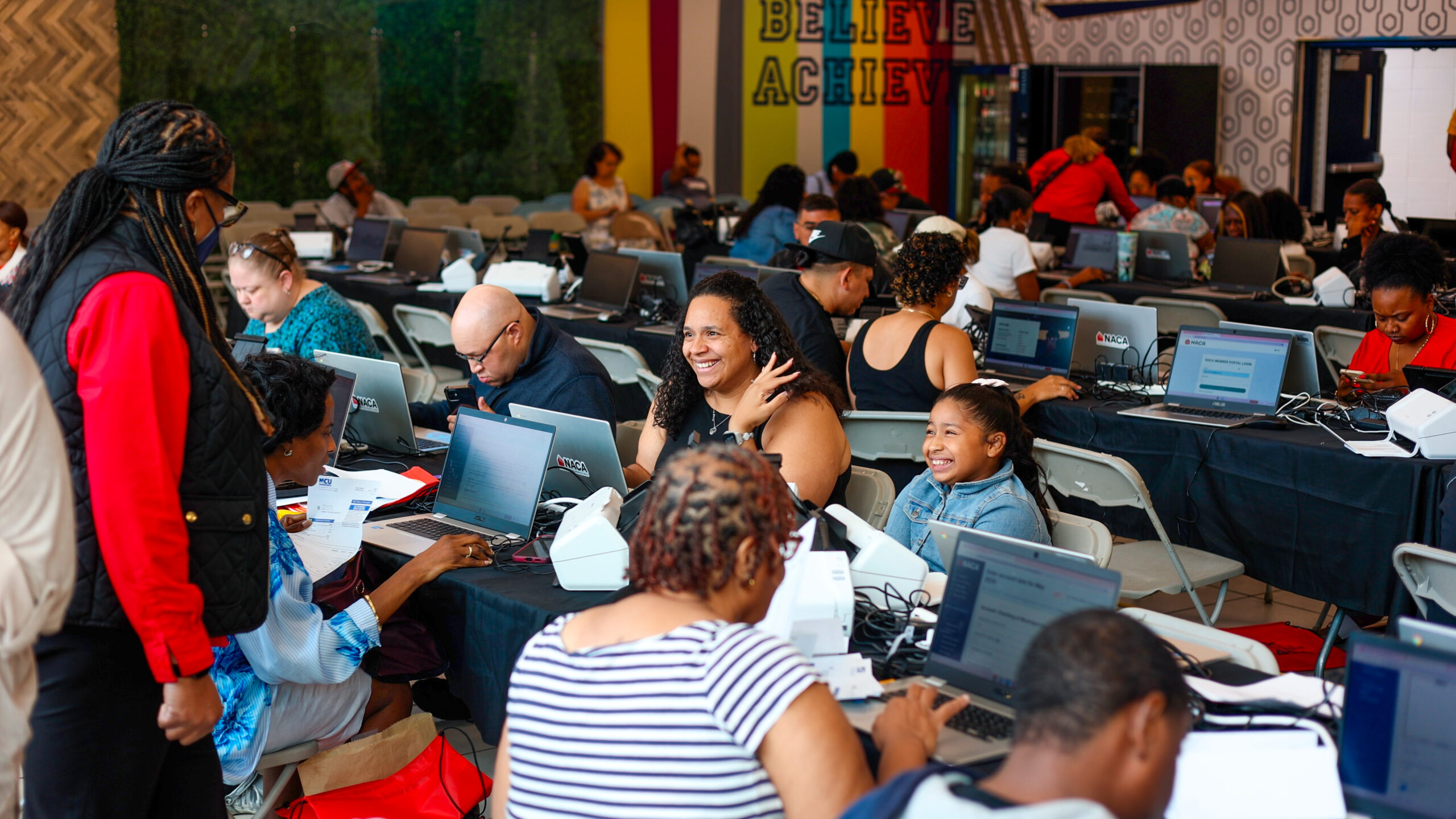

Pictures of the event in Newburgh, NY:

About NACA (NEIGHBORHOOD ASSISTANCE CORPORATION OF AMERICA):

Started in 1988, NACA is the largest HUD-approved non-profit community advocacy homeownership organization in the United States. NACA has been at the forefront of the fight against predatory lending and was the first to campaign against predatory lenders in the 1980s. NACA has the most effective housing counseling program in the country, with a track record of providing affordable solutions to over 250,000 homeowners during the mortgage crisis. NACA provides the Best Mortgage in America through its 47 offices nationwide. NACA’s founder and CEO, Bruce Marks, was named 2007 Bostonian of the Year for his work convincing the major lenders and servicers to modify predatory mortgage loans. He has also testified before Congress on numerous occasions, including on September 12, 2000, when he was one of the few to sound the alarm for the impending mortgage crisis. For more information, please visit https://www.naca.com.